Laden Sie das BPM Partners Whitepaper herunter

17 Best Financial Reporting Tools for 2025

This guide looks at 17 of the best financial reporting tools for 2025. Each one helps finance teams make smarter decisions at every level.

Juni 17, 2025Today, financial reporting looks forward as much as it looks back. There’s no other option. With growth as a top priority in 2025, teams need financial reporting tools that deliver fast, accurate insights and clear direction to act on them.

Yet even as CFOs take the lead in analytics, over half still struggle to produce reports that stakeholders trust. That raises the stakes. Reporting tools have to both make day-to-day work easier and support strategy.

This guide looks at 17 of the best financial reporting tools for 2025. Each one helps finance teams make smarter decisions at every level.

What is financial reporting software?

Financial reporting software helps finance teams make sense of their numbers. It pulls data from spreadsheets, accounting systems, and other sources into one place. With clean data in hand, teams can:

- Identify trends, compare numbers, and track performance over time

- Create dashboards and reports that are easy to read and share

- Plan ahead using forecasts, what-if scenarios, and AI-powered insights

Finance teams are moving away from tedious data prep and toward faster, smarter reporting. That’s why more companies are turning to financial reporting tools, and the global market is responding. It’s set to grow from $10.70 billion in 2025 to $22.64 billion by 2032.

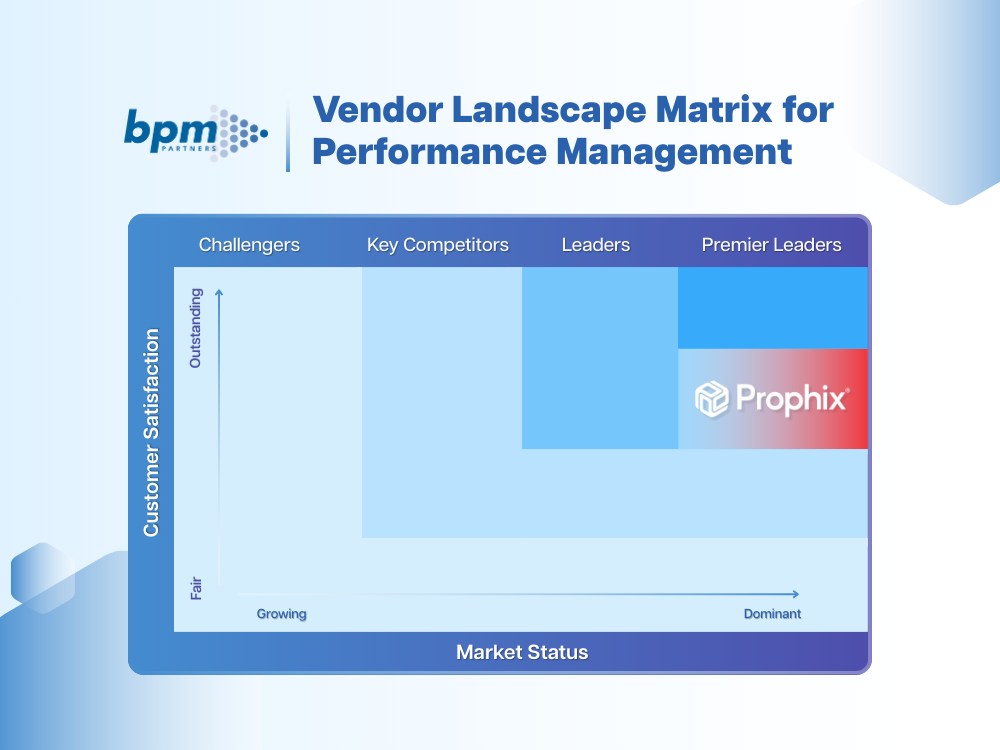

Comparison of the top financial reporting tools

Growing pains hit hardest in financial reports. As businesses scale, the cracks start to show, manual work slows everything down, and it gets harder to trust the numbers or stay compliant.

These problems show up in real ways. Nearly 1 in 5 accountants deal with daily errors, and another 24% say manual tasks hold them back.

The right tool simplifies reporting. It offers a single source of truth, making it easier to build accurate reports and stay on top of compliance. Here’s how the top financial reporting tools stack up.

Determining the right financial reporting solution

Today’s teams need less hindsight and more foresight. That means using financial reporting tools that help finance shift focus from past data to future planning.

Producing accurate financial reports in 2025 starts with clean, connected data. The right tools link directly to your source systems, cutting down time spent fixing errors. This frees up time to focus on the insights that matter, while up-to-date data builds trust in reports and the decisions they support.

With trusted data in hand, teams gain a clearer view of financial health. Custom dashboards and filters make it easier to spot trends, compare performance, and catch issues early.

Look for solutions that:

- Automate reporting to save time and reduce errors

- Support compliance by keeping data accurate

Remember, when reporting is strong and reliable, it shifts finance from a back-office function into a growth engine.

Key features financial reporting tools should have

On paper, many financial reporting tools look alike. But once report building begins, the differences become clear. And when the pressure’s on, these are the features that matter most:

- Data integrity and accuracy: Clean data is the foundation of reliable reports. Getting close to 100% accuracy is key for solid forecasts and budgets. Integrated tools help by applying consistent rules and cutting down on manual fixes.

- Real-time reporting and drilldowns: When numbers shift, real-time reporting and drilldowns deliver instant access to details without relying on outdated exports or extra steps.

- Security and access controls: Security is a baseline requirement. Since 95% of cybersecurity incidents stem from human error, features like user-level permissions and audit trails are essential to protect sensitive data while enabling safe team collaboration.

- Compliance-ready reporting: Regulations move fast. Built-in audit logs and consistent calculations help teams stay compliant without extra manual work.

- Financial disclosure management: Helps teams collaborate on reports and filings in one place. Dashboards and task tracking keep everything visible and on schedule.

- Analytics and variance insights: Great reports explain the “why.” Built-in analytics, and in some cases, AI, can cut down the time spent on manual analysis.

- Integrated dashboards: Dashboards help teams understand performance faster and make quicker decisions.

- Scalable collaboration: As teams grow, reporting needs to scale. Features like version control and automated workflows keep reports accurate and distribution smooth.

Einblicke für die nächsten Finanzführer

Bleiben Sie mit umsetzbaren Finanzstrategien, Tipps, Nachrichten und Trends einen Schritt voraus.